India now uses a simple two-slab GST for hotel rooms: 5% without ITC for rooms ₹7,500 or below, and 18% with ITC for rooms above ₹7,500. There are also rules for when a hotel’s restaurant must charge 18% with ITC. This guide explains the changes in plain, hotel-friendly language and shows what to do next so your Hotel Revenue Strategy stays strong.

- From 22 Sept 2025: rooms ₹7,500 or below → 5% GST (no ITC); rooms above ₹7,500 → 18% GST (with ITC).

- From 1 Apr 2025: the “specified premises” rule for in-hotel restaurants started. In many hotels, restaurants must charge 18% with ITC.

- “Declared tariff” is gone. Thresholds are based on the actual price you charge (value of supply) per room per night.

The new rate card at a glance (with dates)

Quick answer: What is the new GST on hotel rooms under 7500? 5% without ITC from 22 Sept 2025.

“Declared tariff” vs “transaction value”: why it’s simpler now

Earlier, many hotels used “declared tariff” for thresholds. From 2025, that term is removed. Now the rule uses the actual price you charge (value of supply). This means fewer arguments about rack rate vs discount price and easier training for your front office and accounts teams.

Restaurant GST in hotels: “specified premises” (from 1 April 2025)

A hotel is a “specified premises” for a financial year if:

- Last year, any room type sold for more than ₹7,500/night, or

- The hotel opts in through a simple declaration (you can opt out later for the next year).

What to charge in the restaurant:

- If you are specified premises → restaurant services charge 18% with ITC.

- If you are not specified or standalone → 5% without ITC continues.

This brings clarity for in-hotel dining and avoids confusion at POS billing.

How different hotel segments are affected

Budget & mid-scale (rooms ≤ ₹7,500)

- For guests: prices feel lower because GST is 5% (earlier 12%). Expect better conversions, especially in price-sensitive markets.

- For the hotel: you lose ITC on rooms in this slab. Your margin impact depends on how much GST you pay on inputs (utilities, laundry, outsourced services, etc.).

Related searches covered: benefits of GST cut for mid-scale hotels, GST cut benefit to travellers, how budget hotels can use GST reforms.

Upper-mid & luxury (rooms > ₹7,500)

- Rooms stay at 18% with ITC.

- Keeping ITC helps your margins, especially where many purchases and services are at 18%.

- Is the high GST for luxury stays justified? The Government kept a simple two-rate structure—lower rate for mass travel, standard rate for higher-end stays.

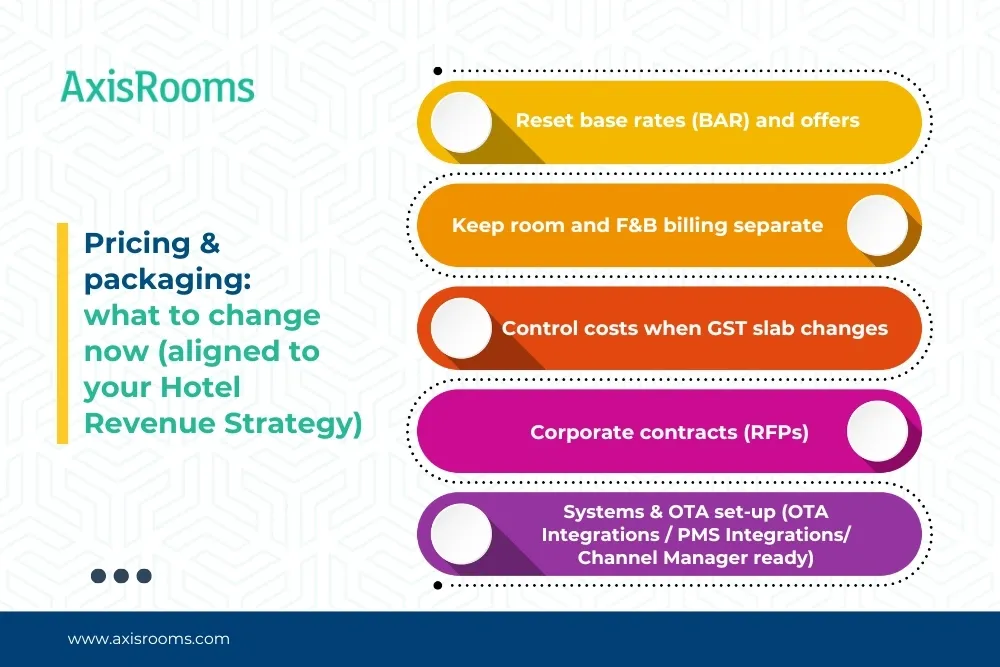

Pricing & packaging: what to change now (aligned to your Hotel Revenue Strategy)

1.Reset base rates (BAR) and offers

- Move from the old 12% logic to 5% for ≤ ₹7,500 rooms.

- Pass most of the benefit to guests, but keep 1–2% to cover lost ITC if needed.

2.Keep room and F&B billing separate

- If your room is ≤ ₹7,500 (no ITC) and you bundle meals, you may mix rules. Safer to invoice room and restaurant separately.

- If you are specified premises, the restaurant should bill 18% with ITC on its own invoice.

3.Control costs when GST slab changes

- Where possible, book more taxable inputs under outlets that retain ITC (e.g., restaurant), if operationally valid.

- Review vendor mix so inputs at 5%/12% don’t hurt margins when room-side ITC is unavailable.

4.Corporate contracts (RFPs)

- Share GST-inclusive rates and clearly mention 5% vs 18% in T&Cs. This makes comparisons easy for corporate buyers and TMCs.

5.Systems & OTA set-up (OTA Integrations / PMS Integrations/ Channel Manager ready)

- Make sure your PMS/PMS Integrations Channel Manager tax settings cleanly apply 5% or 18% to the right rooms and dates. This avoids parity issues and re-billing later.

Compliance checklist (don’t miss this)

- If you qualify as specified premises, file/renew the declaration on time.

- Update restaurant POS, invoice formats, and GST return workings to match new rates.

- Train front office and accounts: use actual price charged; do not rely on “declared tariff”.

Will mid-market hotels earn more or less?

- Guests pay less GST at 5%, so conversion can improve.

- Your margin depends on the balance between ITC loss and extra demand/occupancy. If ITC earlier gave back ~2–3% of room revenue, even a 5–8% occupancy lift can keep EBITDAR steady or better in many city mid-scale hotels.

Product focus — AxisRooms (short & practical)

- Two simple tax profiles: set 5% (no ITC) for rooms ₹7,500 or below, and 18% (with ITC) for above ₹7,500. Push to all OTAs through OTA Integrations

- Show final prices clearly: in the Booking Engine, display tax-inclusive totals; use price rules to keep certain room types below/above ₹7,500 as per your plan.

- Stay in the right slab: add min/max price and last-room availability rules so peak-day price jumps don’t cross your chosen slab by mistake.

Quick setup:

- Apply the two tax profiles to the right rate plans/room types

- Sync to every OTA via the Channel Manager

- Test a few dates to confirm 5% vs 18% shows correctly on your website and OTAs

This keeps your hotel pricing strategy post GST cut consistent everywhere with very little manual work.

Short FAQs 2025 Hotel GST

Q1-What is the new GST on hotel rooms under 7500?

A-5% without ITC from 22 Sept 2025, based on the actual price you charge per night.

Q2-Do luxury hotels still charge 18%?

A-Yes. Rooms above ₹7,500 continue at 18% with ITC.

Q3-How do “hotel GST slab changes” affect my restaurant?

A-If you are a specified premises, your in-hotel restaurant charges 18% with ITC. File the right declaration to set your status.

Q4-Was “declared tariff” used earlier?

A-Yes, but it’s now removed. Thresholds use the actual selling price (value of supply).

Q5-Is the GST cut good for travellers?

A-Yes. Guests in the budget and mid-scale segment pay 5% instead of 12%, which should help demand.